Here at Credit Law Center, we believe in being a team of individuals who are all working for the higher cause and greater good of the company. Our focus and efforts have paid off, and we are honored to rank number 1,578 on the Inc. 5000 Fastest-Growing Private Companies in America. Over the last three […]

Monthly Archives: August 2017

If you haven’t heard the term “identity theft” before you may have been living under a rock. A recent Identity Fraud Study was released this year by Javelin Strategy & Research; this study revealed that 15.4 million Americans were victims of identity theft. These crooks were successfully able to rob two million more victims and […]

Carrying outstanding debt is stressful enough, but when you add aggressive debt collectors to the equation, it can be a bit overwhelming. Have you ever sat back and wondered if what they are doing is legal? Debt collectors do have limits, and they are required by law to follow certain guidelines. Debt collectors must […]

Debt is the amount of money borrowed by one party from another. Consumers typically borrow money from credit card companies or private loans for purchases that they may not be able to afford upfront. Debts are acquired from a car loan, credit card, personal loan or even student loans. In June 2017, U.S. consumer debt […]

Your past financial decisions may feel like they are coming back to haunt you, and handling the complications that arise from having a less than perfect credit score can be rather stressful. Dealing with your past credit mistakes can leave you feeling extremely frustrated and hopeless, but the good there is re-establishing a good credit […]

Are you being sued by a debt buyer? If you have, you’re not alone. Our office has seen a significant increase in clients coming in with lawsuits from debt buyers. What is a Debt Buyer A debt buyer is a company that purchases delinquent debt from original banks and credit card companies, these companies then […]

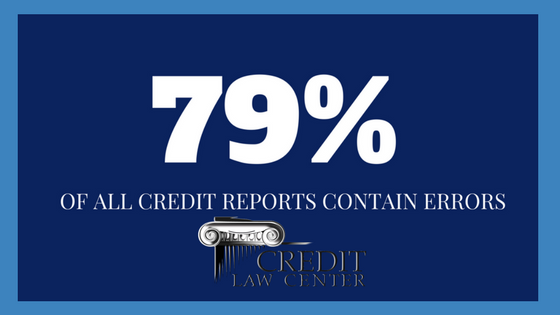

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]

A credit report is a detailed compilation of information about the way you handle your debt, which is managed by businesses known as credit reporting agencies. In the United States, we have three major credit reporting agencies Equifax, Experian, and Transunion. All three credit reporting agencies collect your detailed information from lenders to create a […]

Buying a home can be one of the biggest decisions you will ever make. Once you have decided to take the plunge and buy a home, there are some things you may want to avoid during the process. We have created a list of the 5 Do’s and Don’t of buying a home. 5 Do’s […]