Leaving Credit Card Debt Behind Credit Card debt is increasing for many American families. According to Experian, most family units with a bank card that consists of over $6,000 in debt. For many, this debt can be hard to manage! Do you keep asking yourself why your debts continue to pile up with little to […]

Monthly Archives: May 2023

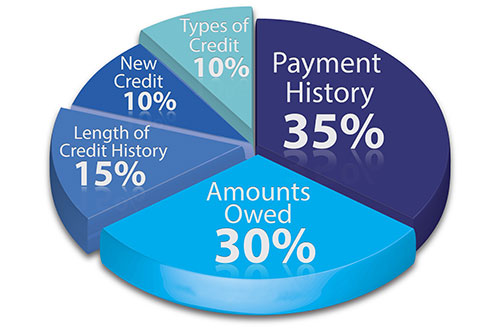

How Could You Be Hurting Your Credit? The more you know about how credit works, the better your score will be. This is because, without a lot of background knowledge, your own logic and reasoning will oftentimes fail you. There are a lot of factors that go into creating your credit score, so trying to […]

There are so many things that come into play to obtain a healthy credit profile. The hardest part of navigating the credit world however, is knowing what advice is accurate and possibly stumbling a few times in an effort to get back on track. Many times consumers think they have a good grasp on it […]

The Federal Trade Commission has stated that reports of identity theft had skyrocketed to record highs in 2020 and continue to to rise in 2022! In 2019 the total amount of reported cases was around 650,00o while cases in 2022 had breached 1.1 million! 2023 is shaping up to have similar results and it is […]

Most everyone has watched the news on the housing market. Interest rates are up, the inventory is low, and the market is slowing. I have had conversations with many people who are wanting to purchase a home, put down roots, and start building equity in their future. But they don’t feel the current market is […]

The cost of bad credit can be very expensive. It can lead to higher interest rates on loans, higher insurance premiums, difficulty getting approved for housing, and difficulty getting approved for employment. The cost of bad credit can range from hundreds to thousands of dollars depending on the severity of the credit situation. The fastest […]

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

So, what are the steps to take in order to know you will be approved for a credit card. There are so many types of credit cards available, what type of card should you realistically expect to attain. There are commercials daily soliciting the “Reward” credit cards. Those sound appealing. Are they right for you? […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

This is really not breaking news at this point. It’s been happening for a couple of years now. But I do think it worth mentioning again. Debt Collection companies CAN try and collect via your social media accounts. Over time, our communication process has changed dramatically. The idea of making a phone call when […]