Whether you are applying for a new credit card or a home loan, hard inquiries are constantly present when attempting to build credit. Although hard inquires are one of the most common items found on a credit report, there is still much mystery surrounding their effect on a credit score. In todays “Fact or Fiction” […]

Monthly Archives: August 2023

Here is a fantastic podcast on the implementation of VantageScore 4.0 to the Mortgage Industry. More importantly this podcast explains the “why” and the benefits of making this happen. If you are in the Mortgage Industry, it’s a great listen and is only around 13 minutes long. Listen to Tony Hutchinson, VP of Industry and […]

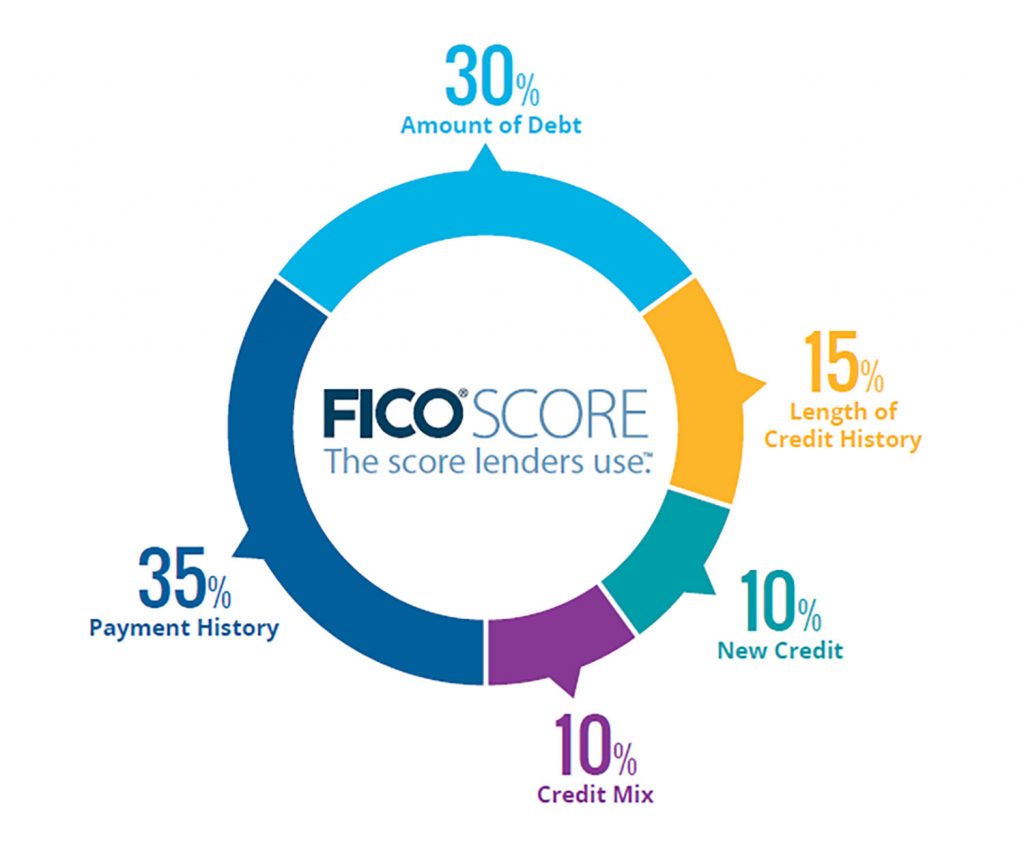

Building Up Your FICO Understanding and building credit in a positive way takes discipline and some education. Do you recall being taught in school, how to build your credit scores? Did your teachers let you know how big of a role credit would play in your life as you got older? Honestly, it is probably […]

How long does it take actually to take for the credit repair process? There seems to be no definite answer on the time frame for how long the credit repair process takes. If you google it, you will see there is not a standard amount of time and no straightforward answer. Unfortunately what happens most […]

Here at Credit Law Center we run into many clients that may have not established credit or they are in a position to where they are need to recover from bad credit. They need to establish open lines of credit to help improve their scores. Talk about being stuck between a rock and a hard place. How […]

Most of are aware of what the three Credit bureaus are. These are companies that use data provided by credit furnisher to assess your ability to pay back debt. They then sell this data to a lending agency with a score that correlates to how they interpret the consumers ability to pay back a loan. […]

On July 31st, 2023 a bi-partisan group of Congressional Representatives wrote to the Director of the Federal Housing Finance Agency, in essence, demanding that the FHFA keeps their deadline in the implementation of VantageScore 4.0 and FICO 10T for determining credit scoring factors in gaining a Home Mortgage Loan. FICO has been the standard bearer […]

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock and make an offer before […]

- 1

- 2