Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report?

So… When was the last time you looked at your credit report? Professionals suggest reviewing your report at least once a year, and you may do that at freeannualcreditreport.com. You’re probably thinking; well what do I look for? Here a few of the most common mistakes on credit reports.

1. Identify Errors

Look for information that isn’t your name, address, date of birth, social security numbers. Credit reporting agencies may often get this type of information mixed up. We see a lot of cases where you may be a Jr and your father a Sr, at one time you lived in the same house, so the credit reporting agencies can easily get this information crossed. Another example of how things can get information can be mixed is f you have a common name like Bob Smith; it’s common to have more than one Bob Smith in the same town. If you have ever been a victim of identity theft, you will want to carefully review this section to make sure the addresses are correct, date of birth.

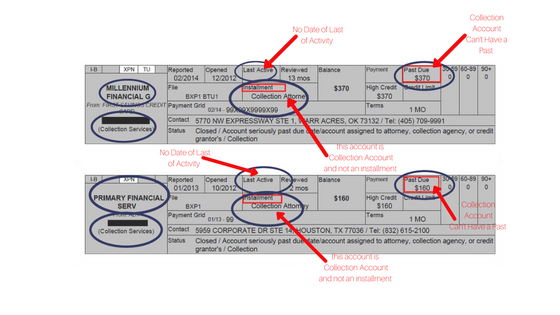

Inaccurate reporting of account status

Inaccurate reporting of an account status can have a significant impact on your credit score. Below are the most common ways per a recent publication from the CFPB.

- Closed accounts reported as open

- Debt listed more than once(possibly using two different company names)

- Incorrect date of last payment, date it was opened, or date of the first delinquency.

- You are listed as the account owner when you were just the authorized user on the card.

- Accounts that are incorrectly reported as late or delinquent.

Here is an example of inaccurate reporting.

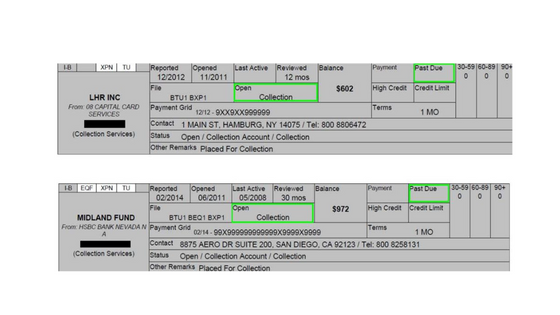

Here is what correct reporting looks like.

What if you find an error?

Finding errors on your report can be upsetting, but always keep in mind that by law credit reports must be timely, accurate and verifiable. There are several different outlets you can take in trying to correct the errors, you may dispute the information with major credit reporting agencies, or seek professional help. Be careful who you choose as some credit repair companies may not be able to help with all areas

Correcting Errors May Significantly Impact Your Score

Leaving incorrect information on your report may significantly impact your credit score and any interest rates that you have on future loans.