How Do Negative Items Affect Me?

Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their effects and even have them removed! Here is a short overview of how long it can take for each negative item to fall off your report!

How Can I Build My Credit?

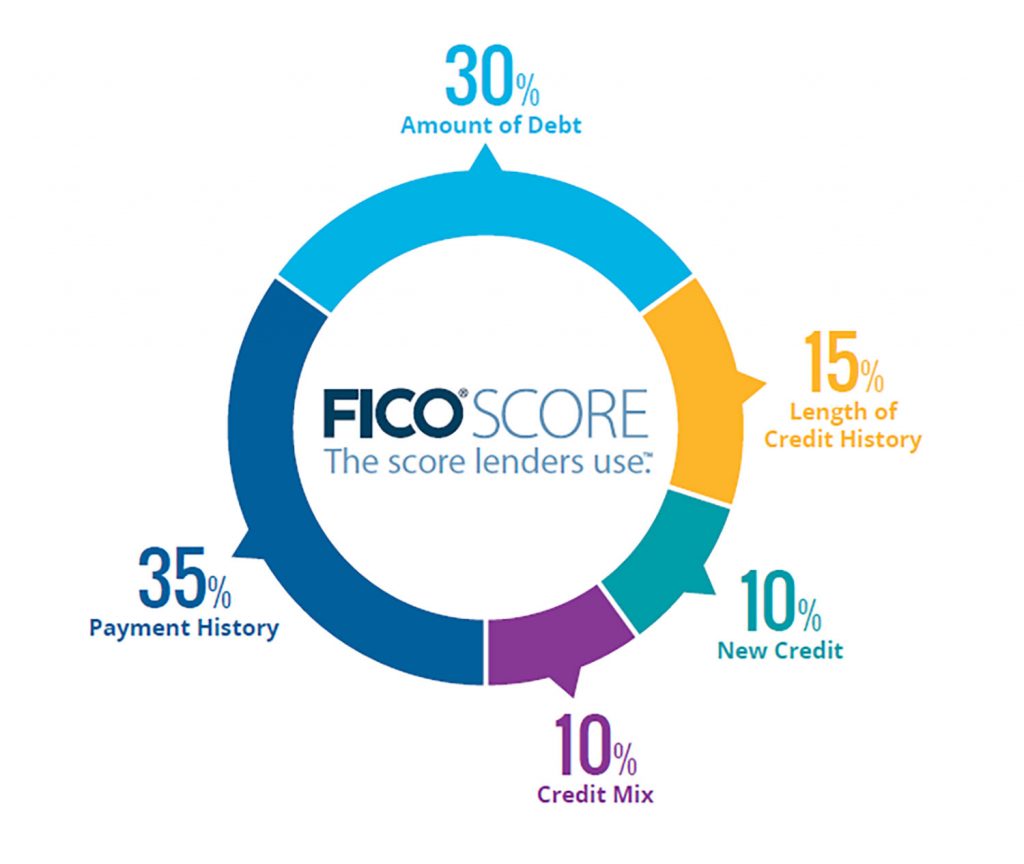

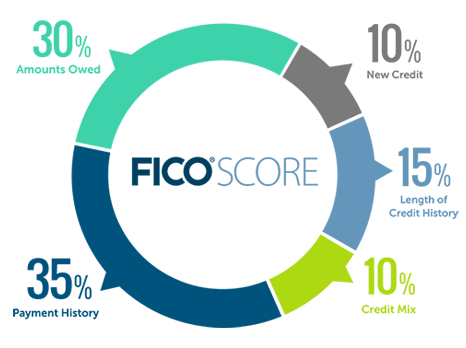

Everyone’s credit is unique to them and building your credit may require more attention in one aspect over another. Your Fico score is made of primarily of 5 different pieces of credit data: Payment History, Amount Owed, Credit History, New Credit and Credit Mix. Each of these catagories holds a specific weight to your final score and if you are found wanting in one area, then you could be harming the other 4!

Each catagory of credit will build off of each other, but without proper understanding of each catagory, you are not reaching your full credit potential.

Payment History- Payment history is self explanitor: Each payment you make toward a borrowed amount will be relayed to the bureaus and listed on your report. Each on time and late payment will show individually under the items profile.

Amount Owed- Each account open on your report holds a particular weight dependant on the amount owed and the type of account it is. You need to take into account your credit utilzation rate on your current cards, your current debts owed and how many open accounts with balances do you have.

Credit History- Credit history deals with how long you have had your accounts open and an average age of your open acounts.

New Credit- New credit takes into account how recently you have applied for credit in the past year.

Credit Mix- Your credit mix is made up of the different accounts listed on the report. This is anywhere from credit cards to mortgages!

New To Building Credit? Here are 5 Easy Steps To Get You Started!

Collection Accounts, Late Payments and More: Seven Years

Collection accounts, charge- offs, paid student loan default, late payments can all stay on your credit report for 7 years.

Some negative items that hang on your credit report for seven years can impact your score more than others. Older negative items that are followed by exceptional credit history hold a lot less weight on an overall score. Many lenders will assess your score to see you are a safe risk and will view your credit history to see if you are a responsible borrower.

Credit repair can help minimize or remove the impact of some of these items and can even help determine the legitimacy of the items on your report! The creditor should be able to determine the current balance of the account, the initial agreement between you and your creditors, the right to peruse the debt and payment history. If the creditor is unable to produce this information, the odds of you getting the items removed early are increased exponentially!

Hard Inquiries: Two Years

Hard inquiries usually stay on a credit report for about 2 years. Most people have inquired on their reports because they are extremely hard to avoid as they occur when lenders run your credit score. The best way to minimize how often hard inquiries land on your report is by researching prior to making an inquiry and submitting loans applications with a single company at a time. The good news is that if you are comparing rates between lenders in a short time frame, multiple inquiries will only be counted as a single inquiry!

Chapter 7 Bankruptcies: 10 Years

A chapter 7 bankruptcy sits on your credit report for about 10 years. The best way to attempt to have a chapter 7 bankruptcy removed from your credit report before the ten-year mark is to undergo credit repair. The credit repair process is to make sure that the information is accurately recorded and all accounts that follow the bankruptcy are taken care of accordingly.

In the End

Creditors do not always send accurate information to the bureaus and accounts can hold a number of discrepancies that could be harming your score!

Inquire for free credit review & consultation.

Contact: 1-800-994-3070