Less Than Perfect Credit Scores and Living Situations. Many families deal with tough situations when it comes to rentals and the landlords that come with them. According to the Business Insider, more Americans are renting than at any time in the last 50 years. I can recall a time when I rented a home that […]

Author Archives: creditlaw2022

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

Believe it or not we live in an age where much of what goes on in our daily lives is monitored, collected and sold to interested parties. Our driving records, our medical history, our internet traffic and most importantly our credit information. Which can make you vulnerable to identity theft or a mistake on your […]

Good, Better, Best and Bad The internet and cell phones have now made it easier than ever to check your credit score as often as you’d like. Millennials are starting to check their credit scores more frequently than any other generation. This could be due to the fact that credit has become vital in many […]

Why Consumers Hire a Law Firm For Credit Repair There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A […]

With Mother’s Day around the corner, it is time to start gathering some ideas on how we can really make the day special! It is no secret that everything is growing more expensive, and it is becoming increasingly difficulty to not break the bank when it comes to gift, but luckily Credit Law Center has […]

How To Deal With Debt Collectors I have recently been receiving strange calls from someone trying to collect money from me, what do I do? As a consumer, it is important to be educated about the process by which an actual collection agency attempts to collect debts as opposed to scam callers asking you to […]

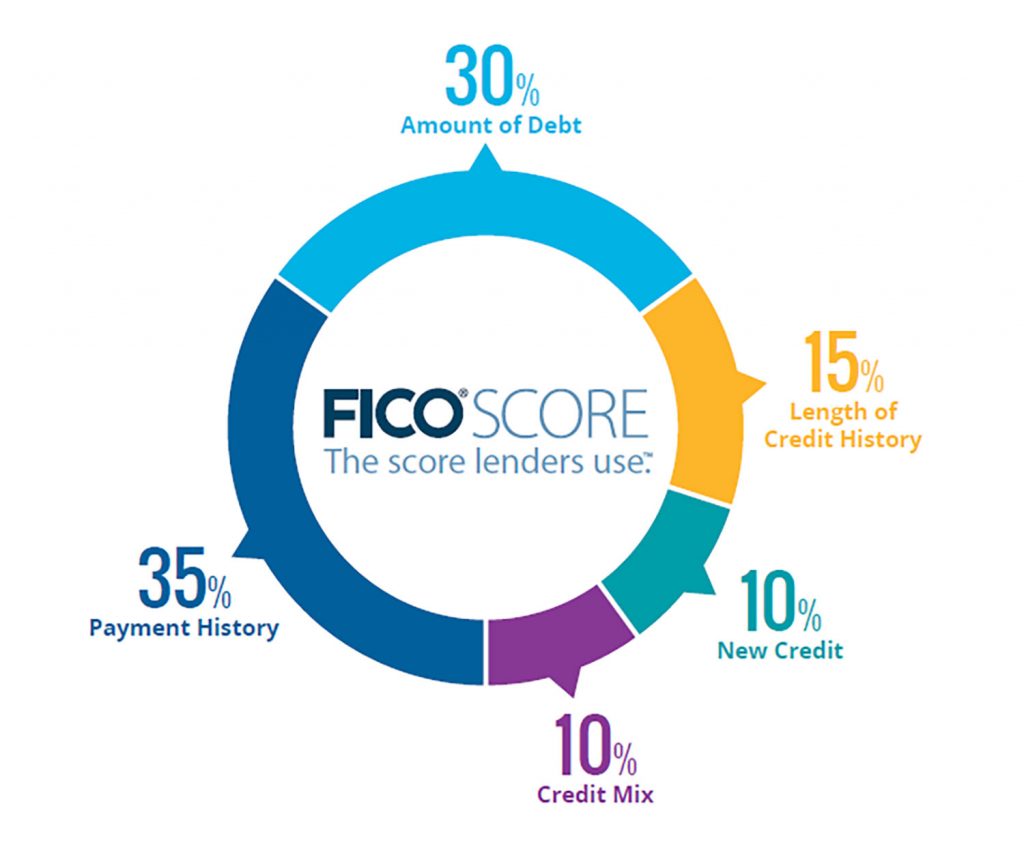

Building Up Your Fico Understanding and building credit in a positive way takes discipline and some education. Do you recall being taught in school, how to build your credit scores? Did your teachers let you know how big of a role credit would play in your life as you got older? Honestly, it is probably […]

Your Fix of the Mix We all know the importance of having a good credit score.With a high credit score, you can open to door to better interest rates, loans, benefits and more! Good credit can be the deciding factor in whether or not you get approved to rent a home or get a particular […]