The Biden administration’s recent rule to exclude medical debt from credit reports has sparked significant debate, with industry groups filing lawsuits to challenge the regulation. The Consumer Financial Protection Bureau (CFPB) finalized this rule to remove an estimated $49 billion in medical bills from the credit reports of about 15 million Americans, aiming to enhance […]

Author Archives: Joe Peters

Debt Begins To Skyrocket Generation Z faces a mounting problem: credit card delinquencies are on the rise, fueled by maxed-out cards and financial inexperience. Born into a digital world of instant gratification, many young adults find themselves overspending, relying on credit to bridge the gap between income and expenses. This trend is exacerbated by a […]

Acclimating to New Changes Last year was an interesting year; with the COVID-19 pandemic and the presidential election, everything seemed slightly different. However, not everything that happened last year was negative, with the previous year bringing some significant updates to VA home loans, which have since significantly increased their usage. According to recent data, the […]

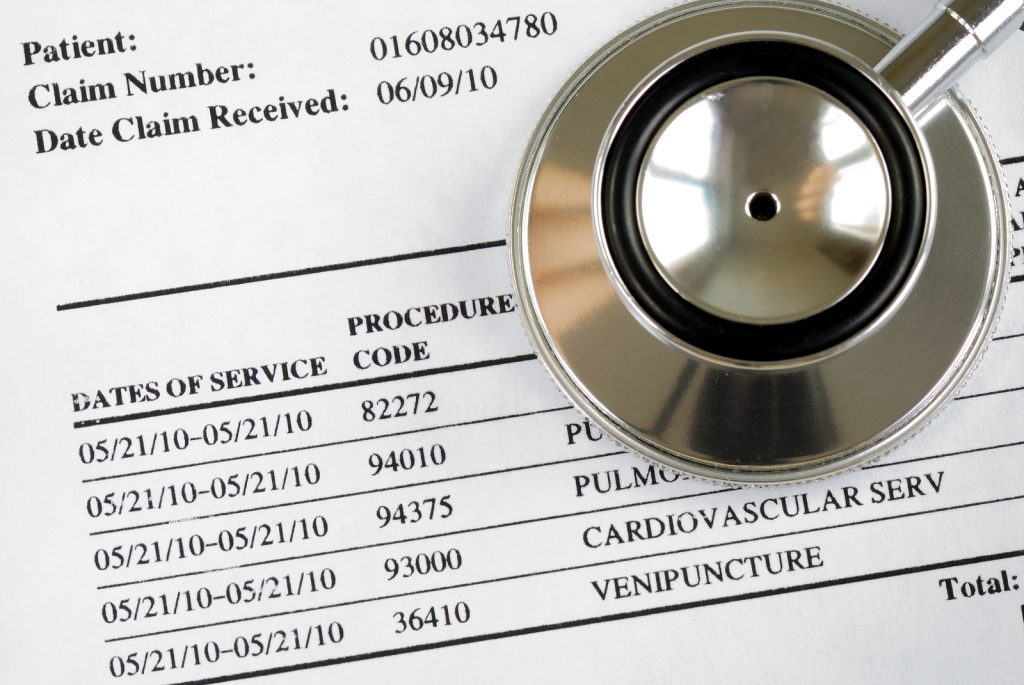

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

Whether you are looking to diversify your credit portfolio with a new line of credit or are searching for the best benefits from a lender, credit cards are normally the easiest way to do so. When most consumers begin looking for a new credit card, they are bombarded with multiple offers stating that their card […]

You’ve worked all year and paid in your income tax to the Government on each paycheck. Now, for many of you, you will file your taxes with the expectations of getting that colorful Department of Revenue tax return in your mailbox! Now what? Shopping spree? Vacation money? If that’s your first thought, you are not […]

I remember sitting around a bonfire one cool autumn evening with a few close friends from high school. We had all gone our separate ways after graduation, some of us went to acquire our degrees immediately, others went off to the military and some went to trade schools to prepare themselves for an apprenticeship. […]

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a […]

Does unemployment affect my credit? Unfortunately job loss is something many American’s experience in their lifetime. The loss of a job means financial hardships, which directly affects our consumer’s credit. Here is what you need to know about how job loss can affect your credit scores. Loss of Savings: Money that was saved for emergency […]

How To Deal With Debt Collectors I have recently been receiving strange calls from someone trying to collect money from me, what do I do? As a consumer, it is important to be educated about the process by which an actual collection agency attempts to collect debts as opposed to scam callers asking you to […]

- 1

- 2