How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Author Archives: John McCall

It’s happened to me. It’s happened to thousands of people. You go to look for your wallet and it’s nowhere to be found. In my case, the thief was only after the cash. All of my credit cards, Driver’s License, and the rest of my belongings were untouched. A city bus driver found it when […]

You’ve worked all year and paid in your income tax to the Government on each paycheck. Now, for many of you, you will file your taxes with the expectations of getting that colorful Department of Revenue tax return in your mailbox! Now what? Shopping spree? Vacation money? If that’s your first thought, you are not […]

Less Than Perfect Credit Scores and Living Situations. Many families deal with tough situations when it comes to rentals and the landlords that come with them. According to the Business Insider, more Americans are renting than at any time in the last 50 years. I can recall a time when I rented a home that had […]

President Trump’s executive order to abolish the Department of Education has raised significant concerns about the future of student loans and their management The Department of Education currently oversees federal student loans for nearly 43 million Americans If the Department of Education is abolished, President Trump has suggested that the management of federal student loans […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

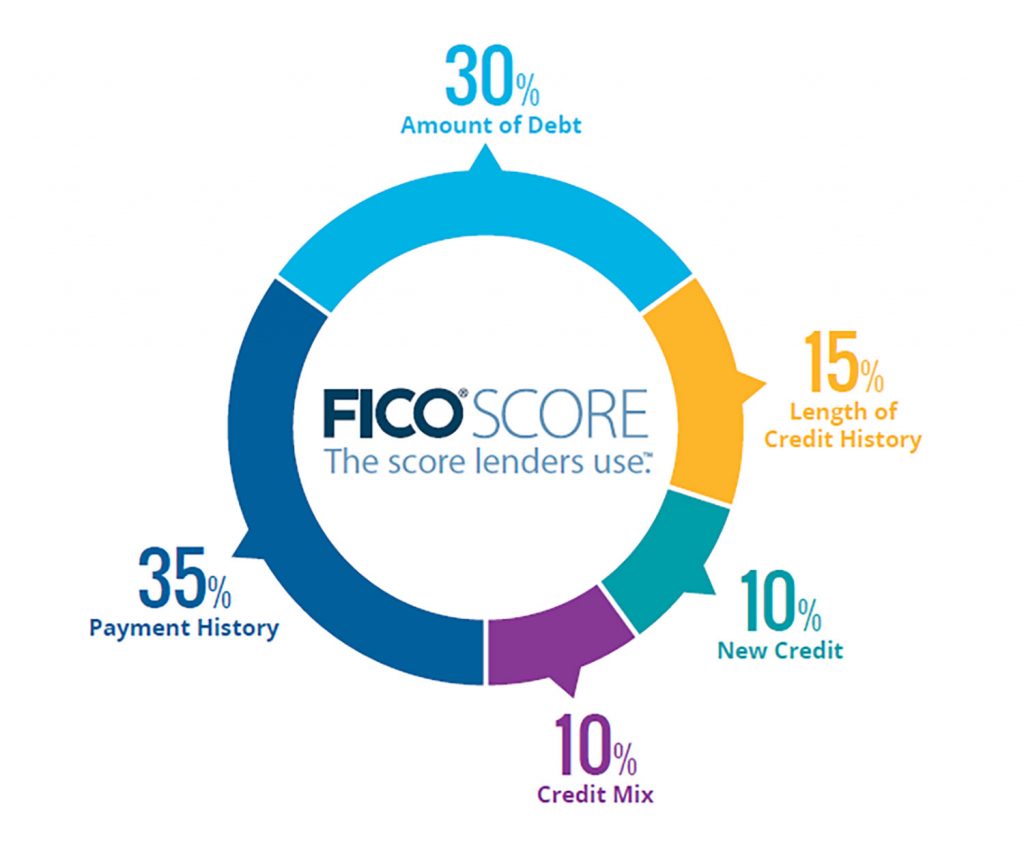

How Does A Decrease In Credit Limit Effect Me? Your credit utilization rate is one of the most important factors when it comes to your credit score. Depending on how much of the available balance you use will reflect what kind of borrower you are and can be the deciding factor in a substantial credit […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a debt and […]