How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Author Archives: John McCall

Saving money and investing is kind of like that New Year’s resolution you made. You know it’s worth it and you’ve said you’ll do it but a week later you’re back to old ways. We are ready to commit to being wise with our money this year-starting with the tax refund! Here is a handful […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

Why choose a Law Firm for Credit Repair? The fact is, there are many Credit Repair Organizations operating in the US right now. There are many good companies out there that have the best interest for their clients at heart. Then again, there are many who don’t. To be perfectly honest, there is no reason […]

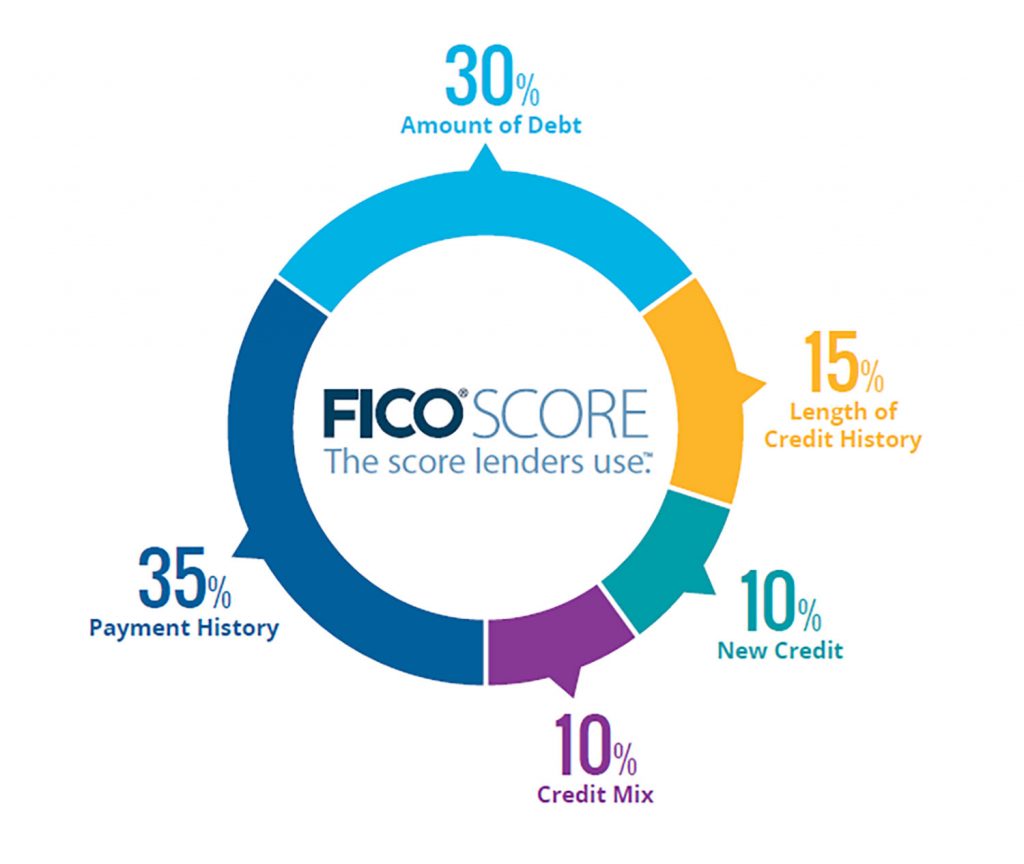

How Does A Decrease In Credit Limit Effect Me? Your credit utilization rate is one of the most important factors when it comes to your credit score. Depending on how much of the available balance you use will reflect what kind of borrower you are and can be the deciding factor in a substantial credit […]

Inboxes full of spam and junk mail, texts coming from unknown numbers alerting you to new investing opportunities, “urgent” mail with pre approved credit and loan offers, and new marketing practices are just some of the annoyances the average consumer must face on the daily. In todays blog, we will go over how to opt […]

FOR IMMEDIATE RELEASE:November 16, 2023 CONTACT:Office of [email protected] CFPB Report Highlights Consumer Protection Issues in Medical Debt Collection Annual report on the Fair Debt Collection Practices Act also describes the CFPB’s and states’ efforts to end the collection of inaccurate medical bills that consumers may not even owe WASHINGTON, D.C. — Today, the Consumer Financial Protection Bureau […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

The cost of bad credit can be very expensive. It can lead to higher interest rates on loans, higher insurance premiums, difficulty getting approved for housing, and difficulty getting approved for employment. The cost of bad credit can range from hundreds to thousands of dollars depending on the severity of the credit situation. The fastest […]

Why choose a Law Firm for Credit Repair? The fact is, there are many Credit Repair Organizations operating in the US right now. There are many good companies out there that have the best interest for their clients at heart. Then again, there are many who don’t. To be perfectly honest, there is no reason […]