Why choose a Law Firm for Credit Repair? The fact is, there are many Credit Repair Organizations operating in the US right now. There are many good companies out there that have the best interest for their clients at heart. Then again, there are many who don’t. To be perfectly honest, there is no reason […]

Author Archives: John McCall

When beginning credit repair, many consumers hold high hopes of ending their repair process with a clean report and a high credit score. Removing a few items here and there can really make your positive credit shine through and can give you the push you need to acquire financing; but that may not always be […]

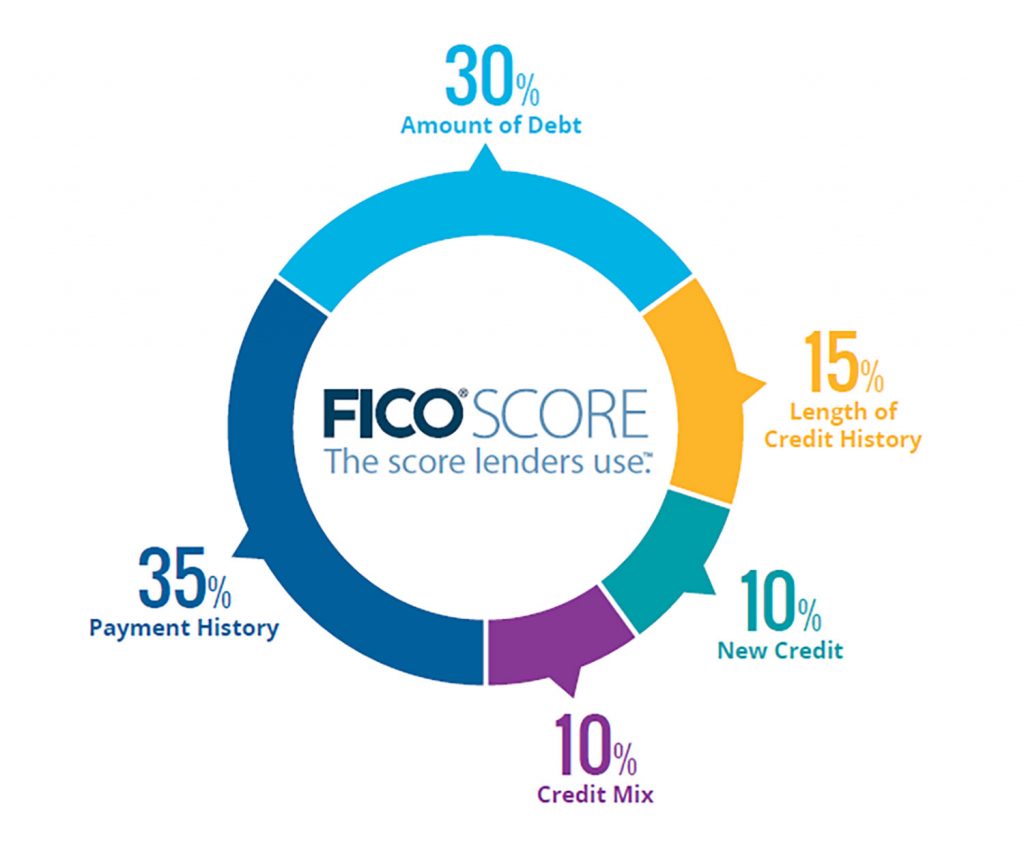

Here at Credit Law Center we run into many clients that may have not established credit or they are in a position to where they are need to recover from bad credit. They need to establish open lines of credit to help improve their scores. Talk about being stuck between a rock and a hard place. How […]

It’s happened to me. It’s happened to thousands of people. You go to look for your wallet and it’s nowhere to be found. In my case, the thief was only after the cash. All of my credit cards, Driver’s License, and the rest of my belongings were untouched. A city bus driver found it when […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Credit Alerts Worth Setting Up Now In order to maintain great credit scores, keeping track of all the activity on your accounts is key! Smart phones are attempting to make our lives easier with a multitude of applications. All major banking institutions now have online banking or apps to make life easier on their customers. […]

If you currently have student loans, here is some very important information about the End of the Federal Student Loan Forbearance Period. For the last 3 three years payments and interest have been postponed for the Federal Student Loans. As of September 1st, 2023 these payments, and the interest accrual, have started again. For most […]

Building Buying Power Have you been picturing the day when you can paint your own walls and mow your own grass? The dream of homeownership comes with great financial responsibility. Many first-time home buyers have questions about their down payment, and how they can start saving to make that first major purchase. We’ll discuss several […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

In our current economic environment, loan rejections are at record highs! This includes all spectrums of credit. Car loans, Mortgages, credit cards, and credit card limit increases. The current rejection rates for applicants stand at 21.8%. This is the highest rejection rate since June 2018. Those with 680 credit score or below are being hit […]