Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

Author Archives: John McCall

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock and make an offer before […]

To piggyback on our last blog, a statement from the National Consumer Reporting Association (NCRA) sounded the alarm of sharp price increases for purchasing credit reports. The surprising fact to me is the vast discrepancies in who is charged and at what percentage the charges will increase. The NCRA stated, “the vast majority of mortgage […]

Last week the Community Home Lenders of America (CHLA) penned a letter to the Federal Housing Finance Agency (FHFA) stating that the pending addition of updated Credit Scores at Fannie Mae and Freddie Mac could be more manageable if done one at a time. Specifically, they stated the need to add VantageScore first. This is […]

Recently released, the CFPB has taken One Main Financial task and ordered them to pay $20 Million for deceptive loan practices and add on services that benefited the company, not their clients. One Main failed to refund interest charges on over 25,000 customers who cancelled purchases within a “full refund period.” They also deceived clients […]

The Why: Phoenix Financial Services attempted to collect on debts that were disputed by consumers and using unlawful letters and misrepresentations to attain these collections. The CFPB took action against Phoenix Financial for numerous debt collection and credit reporting violations. In over a thousand cases, this collection company continued to collect on a debt […]

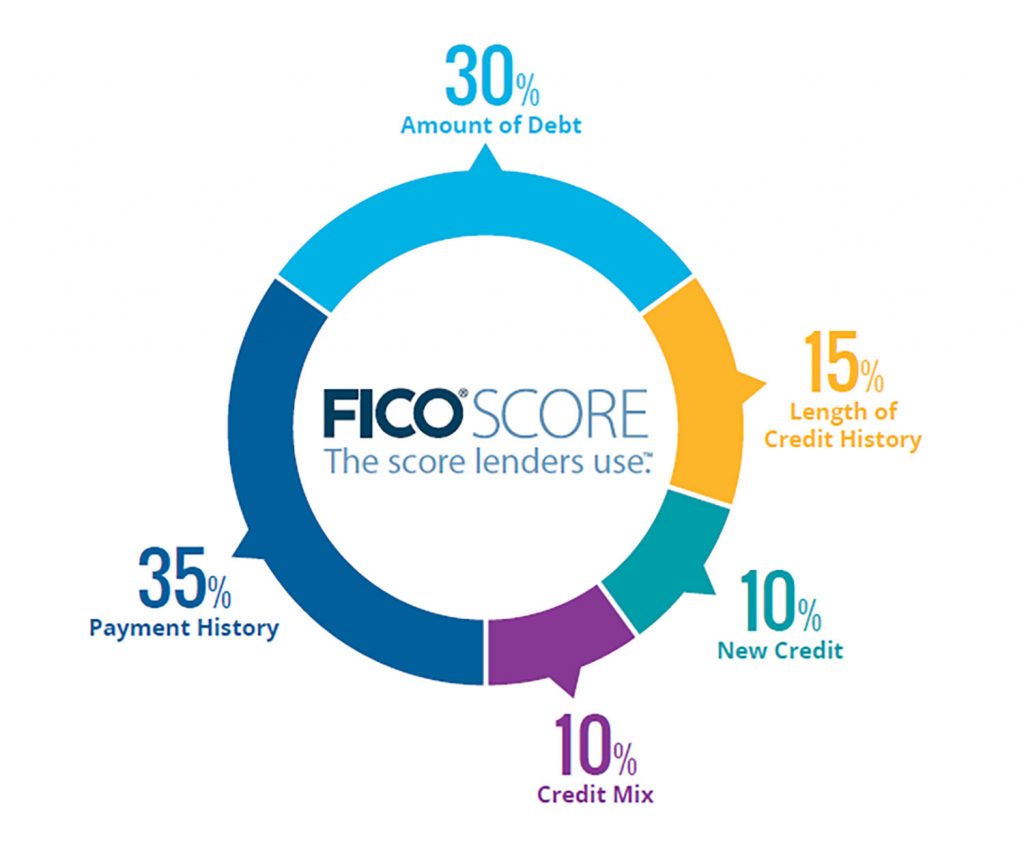

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]