How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

Category Archives: Credit Score

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]

Credit Scores Dropping Have you noticed a random decrease in your credit scores recently? There are many factors that can cause your credit scores to fluctuate. Many consumers do not understand that a credit score has no memory and can change immediately due to activity or changes that can happen as soon as you make […]

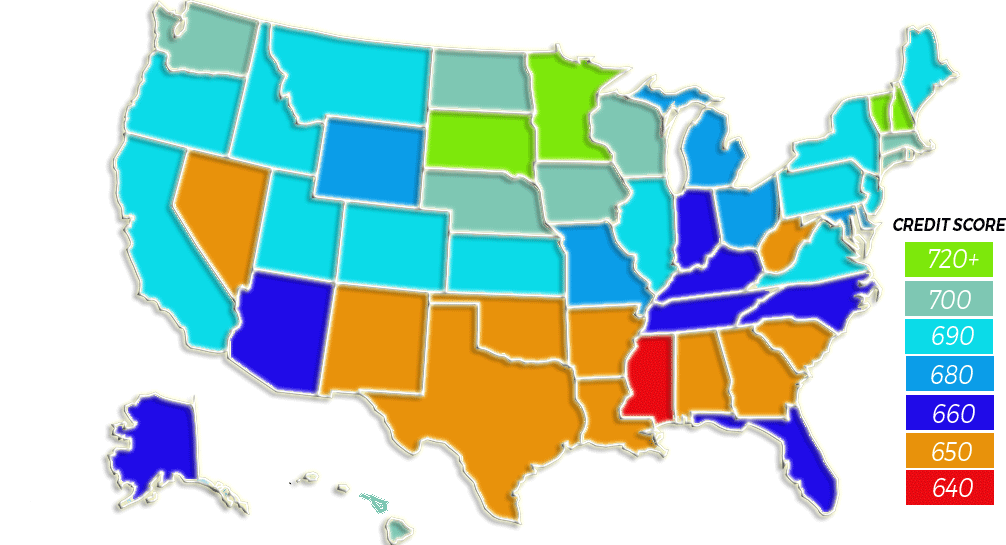

Battle of the States Have you ever wondered what part of the United States has the best/worst credit scores? It may come as a surprise to you but, the highest scoring state, Minnesota has an average credit score of 709. What may come as even more of a shock is that yes, they do have […]

Increased Credit Scores by 100 Points At Credit Law Center we love hearing success stories from past clients. One client shares how Credit Law Center helped her family save money and increase their scores. What brought you to Credit Law Center? I was online one day and was looking at homes. A lender reached out […]

Impact of Timeshares on Credit Reports A timeshare can be something that affects your credit scores. When thinking about purchasing a timeshare, consider it to be as vital and possibly as damaging as a mortgage to your credit report. There are many variables that come into purchasing a timeshare. If your family is tossing around […]

A Step in the Right Direction Potential new changes in the credit world can seem to be irrelevant and often times have little to no impact (or so it seems) for the consumers. There are many changes on the horizon that will take effect just one year after President Trump signs a new bill. Congress […]

All Credit Reports Must Change! All credit reports must change! In response to the New York Attorney General coming out with a settlement, the Credit Reporting Agencies are going through a laundry list of changes. These phases have been implemented over the last few years and phase three is now taking place. There will be […]

2019 Consumer Credit Forecast What’s in store for the consumer credit market in 2019? Increases in GDP personal income. Total employment and the House Price Index among other factors will outweigh potential negatives such as rising interest rates and slowing vehicle sales. Here are four key trends. TransUnion is forecasting- 1. Strong employment and rising […]

When The Chips Fall: Gambling Addiction and Credit Scores As luck would have it, gambling and debt go hand in hand! So what if your hand falls short? Nearly 23 millions Americans lose and fall into debt- losing an estimated $55,000. What happens when you’ve run out of cash and all stashes have hit zero? […]