So now is the time. You’ve been dreaming of becoming a homeowner. Striking out on your own. Building your own equity. No longer wanting to continue contributing to your landlord’s wealth in your monthly rent payments! This thrilling news and a major positive life stage! But what if you are like millions of Americans that don’t have a credit score that will allow you this life changing goal? The great news is that your credit situation could change… rapidly. Rapidly as within 30 days!! Sound impossible? A recent study by the Mortgage Credit Potential Index (MCPI) shows just how a 30-day turnaround in scores is possible. And ¾ of mortgage applications pulled in 2023 are proof that a majority of the “No’s” to a mortgage loan can quickly become a “Yes.”

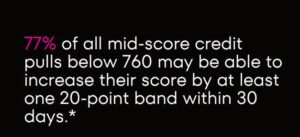

So, how is this possible? Sounds like a pipe dream. I reality, it’s all mathematics. It’s all in an algorithm. We are talking about Credit Optimization. Optimizing your utilization ratios on your revolving lines of credit. MCPI’s report suggests that 77% of all mortgage applications in 2023 could raise their credit scores by 20 points in less than 30 days. Why is this data important? Well, if you’re at a 560, those 20 points may help you qualify for FHA loan and able to start your home search. If you’re at a 640, maybe those 20 points can get you a better interest rate saving you thousands of dollars in the life of the loan.

Those 20 points are the minimum. Many Americans with “Mid-score credit pulls below 760 may be able to increase their scores by at least one 20-point band width.” That being said, getting the most of your Credit Optimization could possibly gain you much more than 20 points.

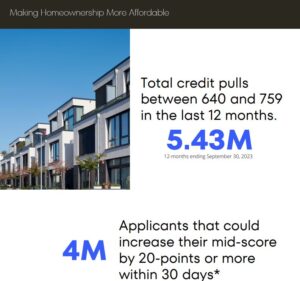

“Total credit pulls between 640 and 759 in the last 12 months are 5.43 million. Of those applicants that could increase their mid-score by 20 points or more within 30 days stand at 4 million.” That’s a lot of potential homeowners or those who could significantly reduce their interest rates on these loans.

So, how does one go about getting the most accurate information and true guidance to aide them in Optimizing their Credit? I have that answer…… please consider visiting our partners at Credit Armor. This is an amazing monitoring site that will guide you through the Credit Optimization process by utilizing their “Score Boost” product. This product will tell you how many points you will gain for “X” amount of dollars you pay your revolving lines of credit. But the BEST part of this product is “Score Boost” will tell you the exact date your creditors report to the three Bureaus. This is an important date, if you want to be one of the 77% that can improve their scores in the next 30-days. Just be sure to pay your trade line down 4 days before they report to the Bureaus, and you will be rewarded on the next month’s credit report.

This site allows the consumer to take advantage of their own financial destiny. Look into it. You’ll be pleased that you did. www.creditarmor.com