All Credit Reports Must Change!

All credit reports must change! In response to the New York Attorney General coming out with a settlement, the Credit Reporting Agencies are going through a laundry list of changes. These phases have been implemented over the last few years and phase three is now taking place. There will be changes again and with more changes and rules, come more mistakes. Continue to stay up to date and educated on your rights as a consumer!

Now, this is not to say that your credit scores will improve immediately or that they will go up or down when you fall asleep but more-so, this article will outline the improvements that are being made in an effort to protect the consumers and their rights when it comes to dealing with the Credit Reporting Agencies. We deal with these institutions every day, so believe me when I say, we hear and see all your frustrations and now, the NY Attorney General has heard the consumers and their frustrations.

If you have not recently checked your credit report, or do not understand what the report has on it, please let someone look at it with you in a free consultation.

Here is what we know about the changes:

The Phases In The Settlement

- Phase One started in 2015-retiring Metro One Reporting Tool which is the software tool that allows the bureaus to communicate back and forth. It was very old and outdated!

- Phase Two started in 2016-creating new policies so that credit reporting agencies now cannot refuse to dispute even if the consumer has not pulled an annual credit report. There must be education and content on the website about the dispute process and allow consumers with more free copies of their credit reports.

- Phase Three happening now-a process will be put in place that identifies and clearly outlines/defines what is being disputed and presented to the consumer.

What you need to know about this round of changes:

Phase Three Implemented June 8th, 2018

- They are now requiring collection agencies to reconcile collections that have not been paid in full. Meaning, the removal or suppression of all collection accounts that have not been updated within the prior 6 months time frame.

- Advised to not report any medical collections that are less than 180 days from the date the debt went delinquent. If a collection is found to be paid by insurance at a later date, it must be deleted.

- If a Credit Reporting Agency receives a notice from another bureau that there is a mixed file, an investigation will be conducted and they will have to correct steps in place to fix the mixed file.

After Your Completed Investigation

After an investigation is completed each bureau is required to take the following actions:

- Report all actions taken by credit bureau regarding the dispute

- Contact information of the creditor/collection involved in the dispute

- The results of the dispute, including any modification or deletions of all disputed items

- If the consumer is not satisfied, the option to re-dispute the items and include any and all supporting documents is given

When you send proof that the information is inaccurate they must get it in front of someone that has the ability to actually make a change to the error on the report.

For clients that we continue to help dispute items on the credit report, we are seeing improvements based on the first few phases of this process. When we have supporting documents that can be sent in and followed up with the dispute, we are seeing fantastic results and usually the turn around time on those is very fast! If you would like one of our attorneys or credit advisors to take a look at your report, please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.

A Note From The Author:The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington

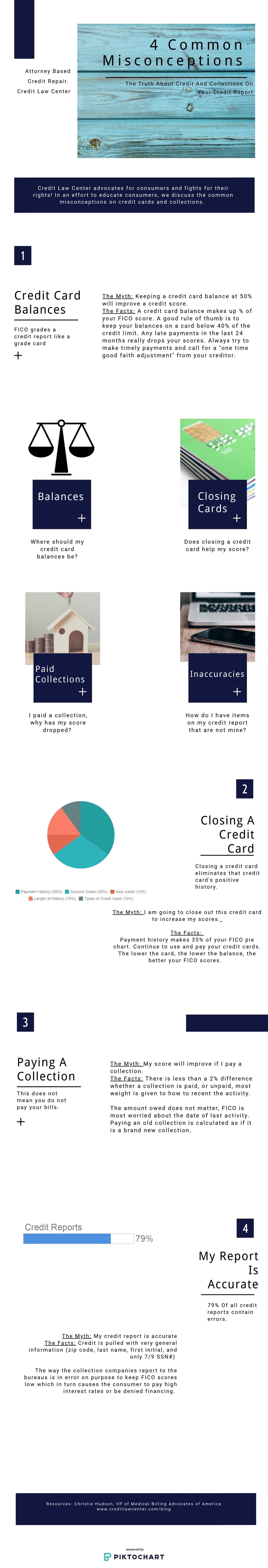

Check out Credit Law Center’s info-graphic on 4 myths of collections reporting on credit reports.