With social media so present in our lives now we see the amount of GoFundMe pages for medical bills, it is validating the statistics. According to a recent report, by the CFPB 43 million Americans have overdue medical debt on their credit reports. Approximately 2 million Americans are affected annually by medical debt and remains the leading cause of personal bankruptcy. Medical debt can stem from a routine medical examine being billed improperly to the insurance company, a tragic accident or a sudden illness.

Medical Debt and Third-Party Collections.

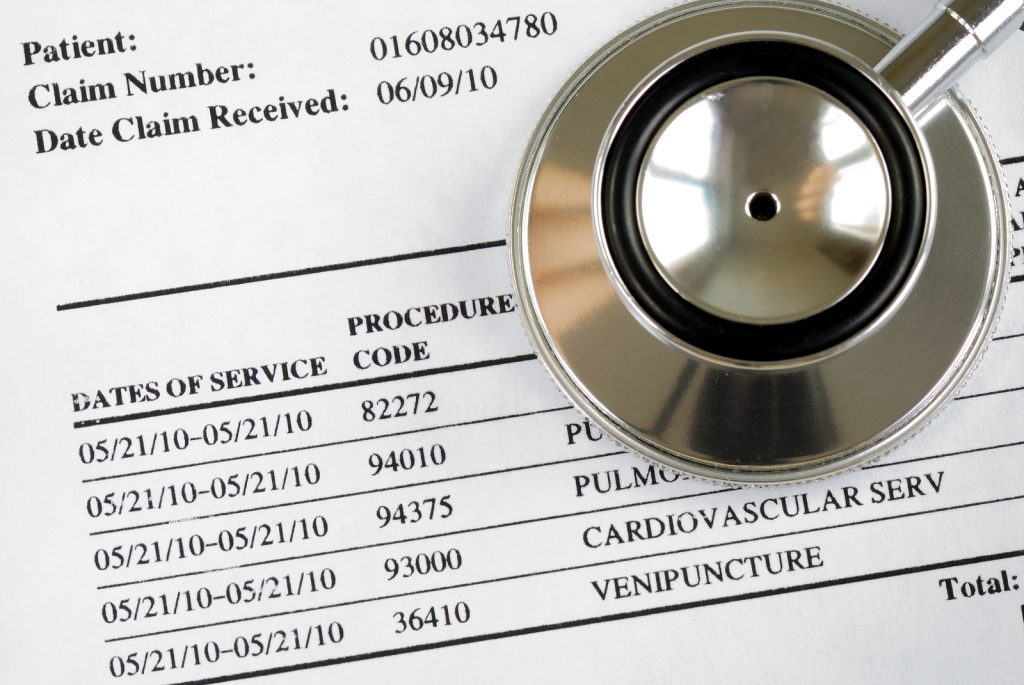

Hospitals and doctor’s offices do not have an active association with the credit bureaus. However, they do have a relationship with third-party debt collectors. Third-party debt collectors do have a connection with credit bureaus, and they will report the negative items to the bureaus. Every medical facility has their set of rules and regulations on how long they will keep a debt before they transfer it to the third-party debt collector. Some medical facilities may move it one day after the due date and others it may be after 60 days past due.

Medical And Credit Scores

When a negative collection item hits the consumer’s report, it may drastically lower your credit score. Having one medical debt on a credit report can lower your score anywhere from 50 to 100 points. There are two different scoring models used, FICO and VantageScore. FICO and VantageScore may be utilized for various reasons, and there are several different variations of both, each industry may use a different version to determine your credit score. For example, the FICO 8, the most commonly used when applying for a loan or a new job until recently, as they just started using the FICO 9. The significant difference between FICO 8 and FICO 9 is that FICO 8 does not separate medical debt from other unpaid debt, so if a lender is using a FICO 9 your score has the potential of being a few points higher.

Things to do to avoid medical debt

The best possible scenario is to pay all bills on time on the due date, in some cases, you may be paying them before the insurance has paid, and the medical facility may reimburse you. That will avoid collections on your report. It is always good advice to know your healthcare plan and understand what your co-pays are as well as your co-insurance, make sure to be familiar with your Explanation-of-Benefits. Being familiar, with your healthcare benefits and knowing what your responsibilities are, and paying the co-pays and coinsurance in advance will help will collections items later. You may always call the healthcare plan and ask them to go over the benefits with you, and you may also ask the medical provider for an itemized statement. Don’t ever be afraid to verify the have billed you correctly. Last but not least call to make arrangements, you may try this first with the provider or if it has been transferred try working with the collection agency before it is sent to a credit bureau.