Most everyone has watched the news on the housing market. Interest rates are up, the inventory is low, and the market is slowing. I have had conversations with many people who are wanting to purchase a home, put down roots, and start building equity in their future. But they don’t feel the current market is the correct time for them to purchase. I know it’s easy to feel that way when just 18-24 months ago interest rates hit an all-time low. Here’s a quote that I feel fits perfectly with their quandary. “In 1971, the interest rates for a mortgage was 7.33%. If you waited for interest rates to go down, you wouldn’t have purchased a home until 1993. You would have rented for 22 years waiting for rates to go down, meanwhile the value of real estate quadrupled. Don’t wait to buy real estate. Buy real estate and wait. Marry the house, date the rate.”

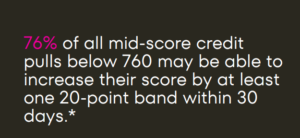

Most often, one’s credit score can affect the interest rate at which you are saddled with at the time of purchase. Gaining 20 points or losing 20 points on credit scores can make a huge difference in what interest rate one could gain. According to the Mortgage Credit Potential Index (MCPI), 76% of all mid-score credit pulls may be able to increase their scores by at least one 20-point band within 30 days. Yes, 30 days. In fact, Total credit pulls between 640 and 759 in the last 12 months was 6.17 million. The amount of mortgage applicants that could increase their mid-score by 20 points or more with 30 days of that 6.17 million is 4.49 million. A HUGE percentage of these mid-score applicants can improve their scores in 30 days!!

Credit Law Center can introduce you to the tools we use to make this happen. Whether it’s working on having derogatory items removed from your credit reports or telling you what you can do on your own to gain as many points as possible… we have the tools and the knowledge to help you get the credit profile before applying for that home loan. Please reach out to us and ask us about our “Score Boost” tool we use with each and every client. Let us see if we can help make your home ownership dream a reality.

800-994-3070