In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a debt and […]

Tag Archives: collection

As of January 2025, the status of federal student loan forbearance is influenced by recent legal and administrative developments. The Biden administration’s Saving on a Valuable Education (SAVE) repayment plan, designed to provide relief to borrowers, has encountered legal challenges. These challenges have led to uncertainties regarding the continuation of forbearance periods and the resumption […]

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a debt and […]

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

Credit and Collections There are many misconceptions about how a collection could impact a credit score. Often times we have clients that think their scores should be higher and have collection companies calling and breathing down their back about paying a collection. They may even promise that if the collection is paid, it will help […]

Your past financial decisions may feel like they are coming back to haunt you, and handling the complications that arise from having a less than perfect credit score can be rather stressful. Dealing with your past credit mistakes can leave you feeling extremely frustrated and hopeless, but the good there is re-establishing a good credit […]

Are you being sued by a debt buyer? If you have, you’re not alone. Our office has seen a significant increase in clients coming in with lawsuits from debt buyers. What is a Debt Buyer A debt buyer is a company that purchases delinquent debt from original banks and credit card companies, these companies then […]

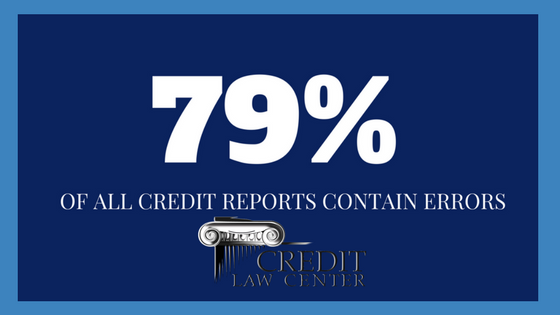

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]

- 1

- 2