How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Tag Archives: credit

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

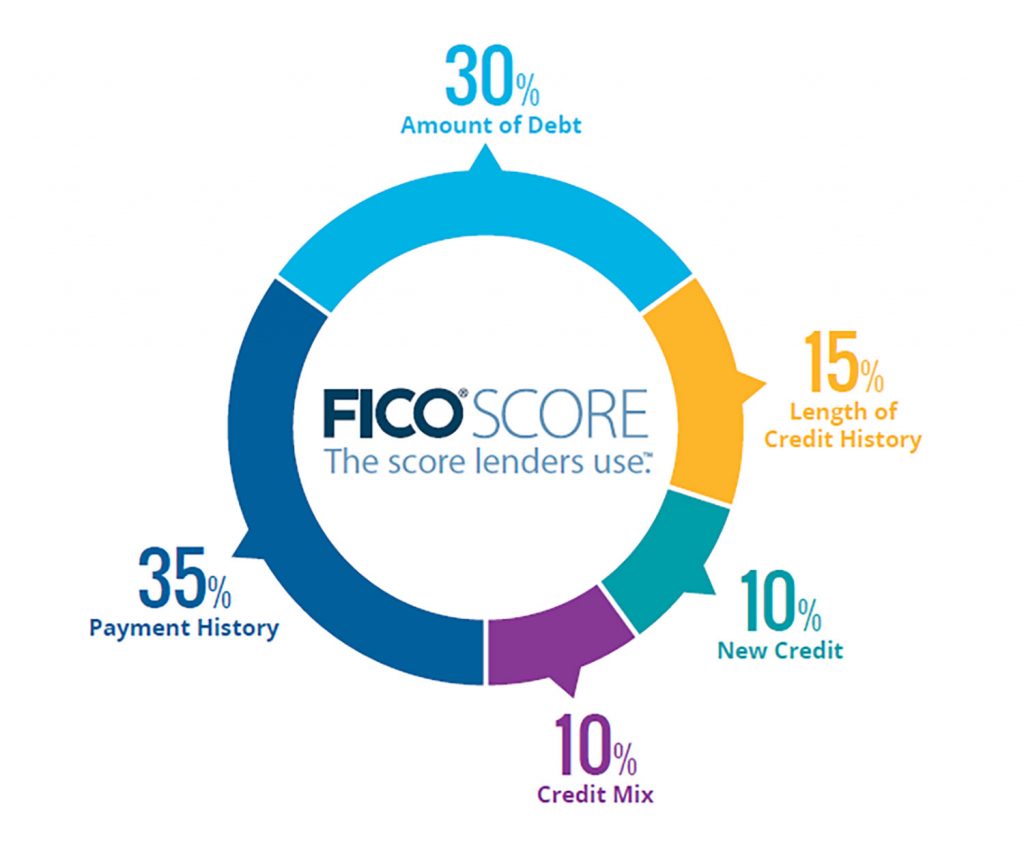

How Does A Decrease In Credit Limit Effect Me? Your credit utilization rate is one of the most important factors when it comes to your credit score. Depending on how much of the available balance you use will reflect what kind of borrower you are and can be the deciding factor in a substantial credit […]

I remember sitting around a bonfire one cool autumn evening with a few close friends from high school. We had all gone our separate ways after graduation, some of us went to acquire our degrees immediately, others went off to the military and some went to trade schools to prepare themselves for an apprenticeship. As […]

The Biden administration’s recent rule to exclude medical debt from credit reports has sparked significant debate, with industry groups filing lawsuits to challenge the regulation. The Consumer Financial Protection Bureau (CFPB) finalized this rule to remove an estimated $49 billion in medical bills from the credit reports of about 15 million Americans, aiming to enhance […]

Now that the new year is upon us, it is time to start on our resolutions for the year. My group of friends all discussed what we wanted to work on this year to better ourselves and the lives we live as we sat painting miniature figurines. A couple of us are looking to hit […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

Building Buying Power As the Spring months start peeking through, the home buying market is heating up! Have you been picturing the day when you can paint your own walls and mow your own grass? The dream of homeownership comes with great financial responsibility. Many first-time home buyers have questions about their down payment, and […]

How To Deal With Debt Collectors I have recently been receiving strange calls from someone trying to collect money from me, what do I do? As a consumer, it is important to be educated about the process by which an actual collection agency attempts to collect debts as opposed to scam callers asking you to […]