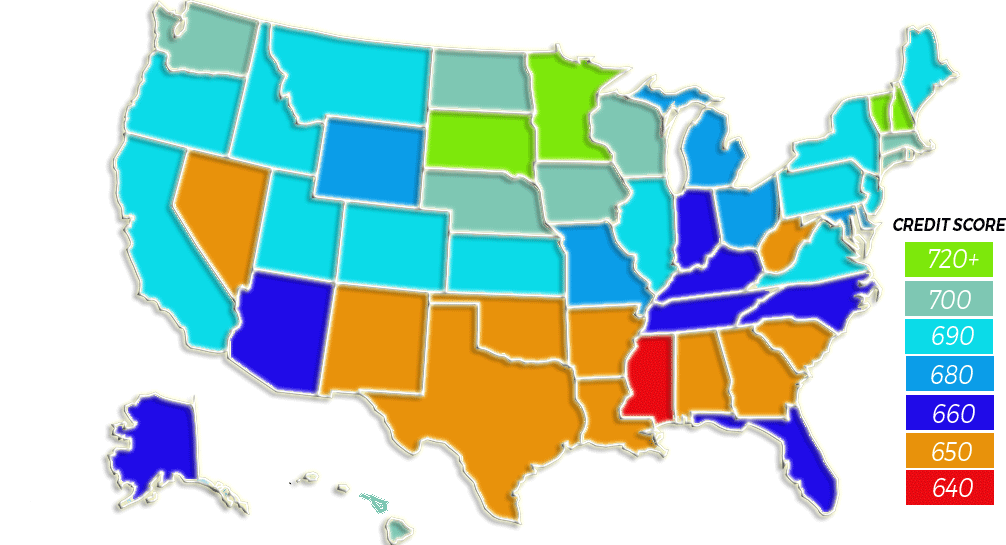

A Record-Breaking Year We have seen the highest average credit score ever in 2019 and the numbers keep rising! The U.S. economy is truly booming: Record job growth caused unemployment rates to drop to a record low and the stock market flourished throughout the year. Consumers showed their confidence as they continued to […]

Tag Archives: credit law center

A Road Map For Building Credit How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is […]

I Have No Credit History! “I’ll just pay cash for everything.” I have said many things in my life with the best of intention, but this had to be the one that hurt the most when it failed. When I was younger, like most people out there, I saw credit as a trap to get […]

2018 Top 10 Credit Repair Blogs Thank you to all of our 2018 clients for giving us a fantastic year for Credit Law Center. From our new facility to the thousands of lives we have made an impact on, we wanted to share what we learned last year in the same order that you liked […]

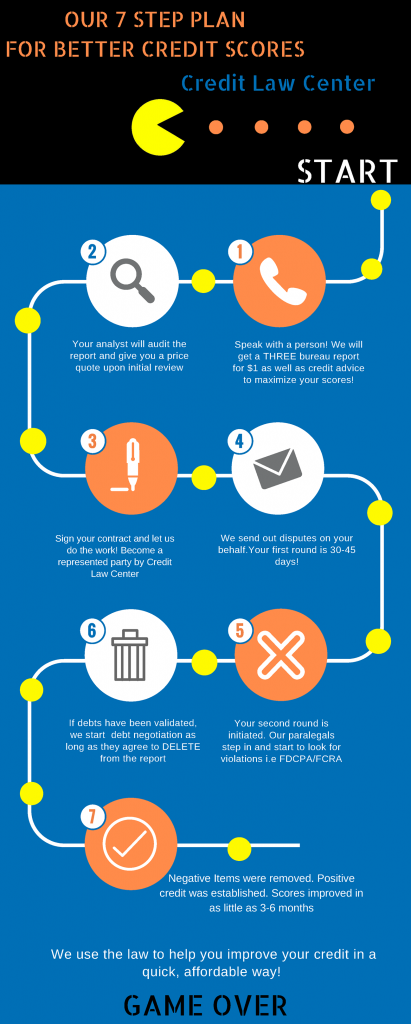

Quick and Affordable Credit Repair That Works When you are interested in a product where do you normally go for feedback? If you immediately go to the review section of a product or turn to friends for their recommendations you are like most consumers out there! With the device in your hand that you are […]

Have you been affected by the Equifax hack? On Thursday, Equifax, one of the three major credit reporting agencies announced that hackers had obtained access to company data potentially impacting approximately 143 million U.S. consumers. After the companies recent investigation, Equifax stated that the unauthorized access occurred from mid-May through July 2017. The cybersecurity incident was […]

Impact of Timeshares on Credit Reports A timeshare can be something that affects your credit scores. When thinking about purchasing a timeshare, consider it to be as vital and possibly as damaging as a mortgage to your credit report. There are many variables that come into purchasing a timeshare. If your family is tossing around […]

Ballparks On A Budget For once, feeling blue is good! (Royal blue that is) and dare I say it, but baseball season is finally here again! If you have looked at the ticket prices at Kauffman Stadium lately you’ll notice they have not gone down. In 2018, the average ticket price for a Cubs game […]

The Ultimate Cheat Sheet on Student Loans The price for higher education is rising, as is the numbers on student loan debt. What is deemed necessary to be successful in today’s world, is also what is holding many folks back from financial freedom. While many are trying to get ahead in their lives, student debt […]

Credit Reports. The Soft and Hard Pull Inquiry Finally Explained There Are Two Main Types of Credit Inquiries Chances are when you have applied for a credit card or a loan, you have heard the term “inquiry.” This inquiry is a credit check to take a look at your credit report, but there is a […]