What makes up your FICO score and how is it calculated? A FICO score is a 3 digit code measured by pulling data from all three credit reports, Experian, Transunion, and Equifax, it is then used to determine your credit risk to lenders. The information pulled is put in to a FICO Score Formula, as a result this Score may raise or lower depending on the type of information being reported on your credit reports.

This score is currently being used by approximately 90% lenders to determine the credit worthiness of a buyer.

The FICO Score will only contain information about your credit history and will not include your race, color, religion, national origin, sex or marital status, etc, furthermore preventing any kind of discrimination.

Credit Worthiness

A FICO score may range anywhere from 300-850, depending on key factors in your credit history. Having a FICO credit score above 800 you gives you a greater chance of obtaining credit from a lender, while a lower FICO score will decrease the ability to obtain credit.

| 800 or above | Flawless |

| 750-799 | Excellent |

| 700-749 | Good |

| 650-699 | Fair |

| 600-649 | Not Good |

| 580-599 | Poor |

| 500-549 | Very Poor |

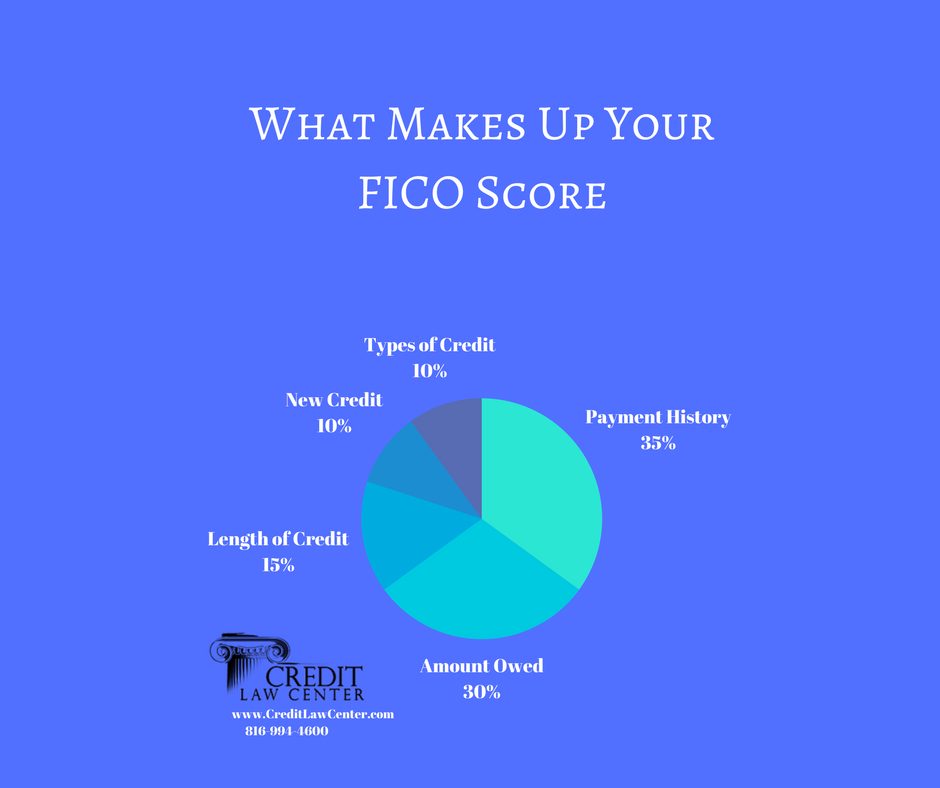

Key Factors in calculating FICO Credit Score.

Payment History makes up about 35% of your FICO credit score. Payment history is calculated by the history of payments on your credit cards, retail, installment loans and mortgage payments. In order to reach a higher FICO score you should have very few or no late payments.

Amounts Owed attributes to 30% of your score; amounts owed is the amount owed on all accounts, the amount of money being used on different types of credit, how many you are utilizing and the balances. The lower the amount being utilized the better this will help your FICO score.

Length of Credit History is 15% of your FICO Score, length of credit history is calculated by looking at the age of the oldest accounts, how long ago the trade line was established, and how long since you used it. Having a long solid history of credit usage is the best to obtain a higher score.

Types of Credit makes up 10% of your FICO score; types of credit is determined by looking at different trade lines in your report, whether it is an installment loan, Credit Card, Mortgage, etc. It is best to have a healthy mix of credit lines when wanting a higher FICO Score.

New Credit is 10% of your FICO Score; how often you shop for new credit. One with a higher score is usually more strategic at obtaining new credit, it is beneficial to wait or even research new credit before applying.

FICO Scores look at both positive and negative on credit reports, having late or missed payments will drastically lower your score, but in return maintaining a good payment history will raise your score. Negative items such as bankruptcies, public records, lawsuits, liens and judgments will potentially affect your FICO score negatively.

Things to help improve your FICO Score

The wonderful thing about a FICO score is that it is your individual report and you are the only one that has the power to raise your score. Raising a FICO score is not an overnight task, even when working with a credit repair company or credit restoration company, it is important that the consumer takes into to consideration what makes up your score.